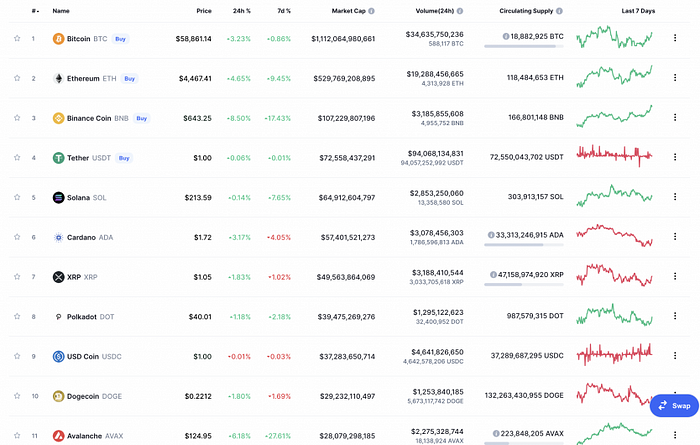

We talk about a cryptocurrency that managed to get into the top 10 most expensive virtual currencies, displacing DOGE from there.

One day, the Avalanche (AVAX) cryptocurrency, which appeared as if from nowhere, showed record growth and even managed to break into the top 10 cryptocurrencies by capitalization.

However, in May 2022, the altcoin lost $60 million due to the collapse of Terra. Against the backdrop of these events and the general collapse of the cryptocurrency market, the price of AVAX has been declining for several months. At the end of 2021, the cost of Avalanche reached $134, in October 2022 it is equal to about $17.

Where did the AVAX altcoin come from, what can it offer users and can it really seriously compete with Ethereum? We understand our material.

History of Avalanche

The Avalanche open source platform, whose native token is AVAX, appeared in the fall of 2020. Her slogan reads:

How Avalanche differs from other Ethereum competitors

Avalanche was invented by Emin Gün Sirer, a Turkish-American computer scientist, professor at Cornell University and future founder of Ava Labs. Prior to Avalanche, Sirer worked on various operating systems, as well as solutions to scale and improve the security of bitcoin. It was Sirer who found one of the serious BTC vulnerabilities called “selfish mining” and proposed a solution to it.

Selfish mining is a strategy where bitcoin miners team up to increase their income. Ultimately, it leads to the centralization of BTC, which should be decentralized, and to the advantage of some mining pools over others.

Interestingly, Sirer tried to create his first cryptocurrency, called karma, back in 2003 — six years before the advent of bitcoin.

With Avalanche, Sirer tried to solve the main problem of modern blockchains — slowness. Even the fastest options conduct transactions several tens of times slower than the systems that belong to Visa and Mastercard.

Let’s compare cryptocurrencies and payment systems in terms of the number of transactions per second:

Bitcoin (BTC) carries out 6 transactions per second on average.

Ethereum (ETH). For ether, this figure is 15 transactions.

Avalanche (AVAX). A few months before the full launch of Avalanche, Sirer said that his platform can process 6.5 thousand transactions per second. The Avalanche website says about 4.5 thousand.

The Visa network can handle 24,000 transactions at once.

Solana (SOL) boasts an astronomical 60k transactions per second.

According to Sirer, the impressive speed of Avalanche was achieved thanks to a fundamentally different consensus algorithm. If in the case of the Ethereum blockchain all network nodes must have the same amount of information, then Ava has one node interacting with a limited number of nodes that together make up the network or the so-called “word of mouth” (Gossip Network). This scheme allows you to significantly increase the speed.

The Sirera platform supports a fairly standard set of features: creating smart contracts, decentralized applications, as well as launching your own private and public blockchains.

But the creators assure that their platform, among other things, is much safer than competitors that work on the Proof of Stake algorithm. This is happening, the developers say, due to a larger number of validators, that is, nodes that verify and confirm operations on the blockchain.

The Proof of Stake algorithm that Avalanche uses is less energy-intensive than the Proof of Work algorithm that Bitcoin uses, which allows us to talk about its “environmental friendliness”.

What is Avalanche cryptocurrency

Cryptocurrency Avalanche, or AVAX, is a native token of the platform, with which all operations are performed on it.

The first private sale of AVAX tokens took place in May 2020, when nearly 25 million coins were sold to investors at a price of $0.50 for a total of $12 million. In July 2020, Avalance managed to raise another $42 million from investors during the ICO.

You can get AVAX by buying an altcoin on exchanges or by receiving it as a reward for keeping the blockchain running.

There are two options to keep the network running:

A validator is a network user who maintains one of the network nodes with the help of staking, and for this he receives a reward.

A delegator is a user who does not want to take care of their host, but still wants to receive a reward. Such a user delegates (that is, transfers) their AVAX to the validator and receives part of the reward for this.

At launch, 360 million AVAX coins were minted, with another 360 million to be distributed among users as staking rewards. The coins paid as network fees are then burned to create a deficit.

Avalanche exchange rate history

AVAX went public with a price of about $4. In the following months, the price of the altcoin remained close to this figure, sometimes sinking below $3.

The first notable increase in value occurred in February 2021, when the value of the virtual currency jumped to $55. The next time AVAX managed to return to this level only six months later — in August. This came amid the launch of a $180 million initiative to attract decentralized application developers to the platform.

Starting from November, the cryptocurrency exchange rate began to add several dollars almost every day. If on November 1, AVAX was worth $65, then by the 20th, the value of the altcoin rose to $125, and in the next few days reached a historical maximum of $146. At the same time, the cryptocurrency managed to rise to 10th place in terms of capitalization.

Why Avalanche has grown so much

Most experts attribute the altcoin’s record growth to a partnership agreement that the platform’s creators have signed with Deloitte, one of the world’s largest consulting firms. Under the terms of the agreement, Avalanche and Deloitte will develop a solution that will improve the work of the US Federal Emergency Management Agency.

The partnership with Deloitte was preceded by several other initiatives totaling $600 million, the announcement of which could give an impetus to the growth of the rate.

At the time of writing, AVAX is worth about $125 and has fallen to 11th place in the list of the most expensive cryptocurrencies according to CoinMarketCap. The market capitalization of the altcoin exceeds $28.5 billion.

Avalanche Price Forecast

CoinPriceForecast believes that by the end of 2023, the price of AVAX will rise to $31.37.

Wallet Investor offers a more optimistic forecast that AVAX could hit around $38.2 by the end of 2022. However, the altcoin will not break the $1,000 mark until at least 2031, the site predicts.

If You Want To Learn More How To Make Big Money And Passive Income With Cryptocurrency Click Here

Affiliate Disclosure:

The links contained in this product review may result in a small commission if you opt to purchase the product recommended at no additional cost to you. This goes towards supporting our research and editorial team and please know we only recommend high quality products.